How to leverage cutting-edge financial technology to supercharge your wealth-building

by George Antone

I recently watched a fascinating documentary, APEX: The Story of the Hypercar. It explores an emerging class of exotic sports cars—the so-called “fighter jets of the street.”

The world’s leading automobile manufacturers, including Koenigsegg, Bugatti, Porsche, Ferrari, and Pagani, bring these incredible machines to life. From initial conception to the racetrack, the modern hypercar is an expression of expert engineering, cutting-edge computer design, and unfettered human imagination, designed to blast from 0 to 200 miles per hour in just seconds.

As a Marvel fan, I particularly enjoyed a line in the documentary that described a hypercar as “The Iron Man suit as a car.”

While watching this documentary, I began to draw several parallels between the hypercar and Fynanc’s financial technology.

Why Amplified Investments Perform Better

You’ve probably already heard about the benefits of investing in real estate. Many people don’t realize that real estate is such an effective investment because of mortgages. This debt acts as an amplifier: it can make a good deal better or a bad deal devastating.

The mortgage alone can make or break an investor. Combining well-structured debt with the right type of assets is one of the best wealth-building tools.

Let’s again think about this through the metaphor of a high-performing hypercar. These cars rely on various critical pieces working together with unmatched efficiency. Underperforming parts can be swapped for high-performance components. It’s no different with income-producing assets.

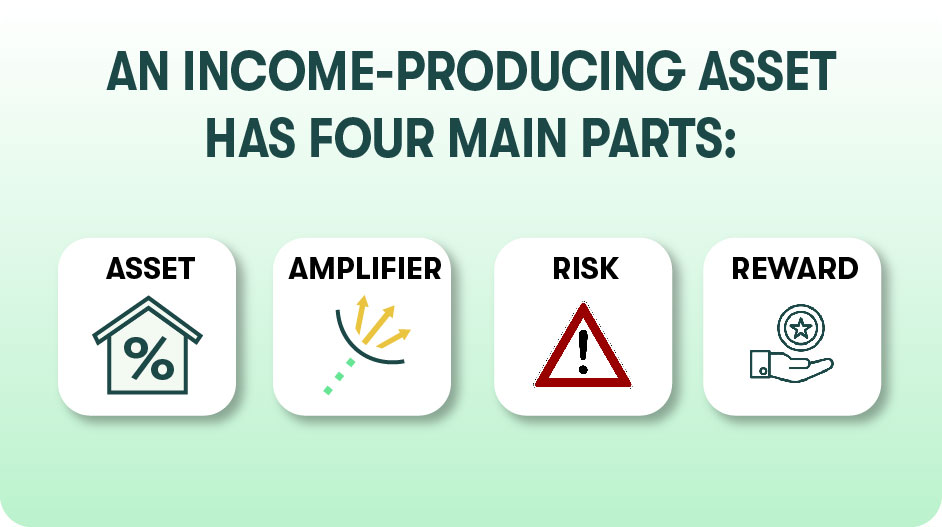

At a high level, an income-producing asset has four main parts:

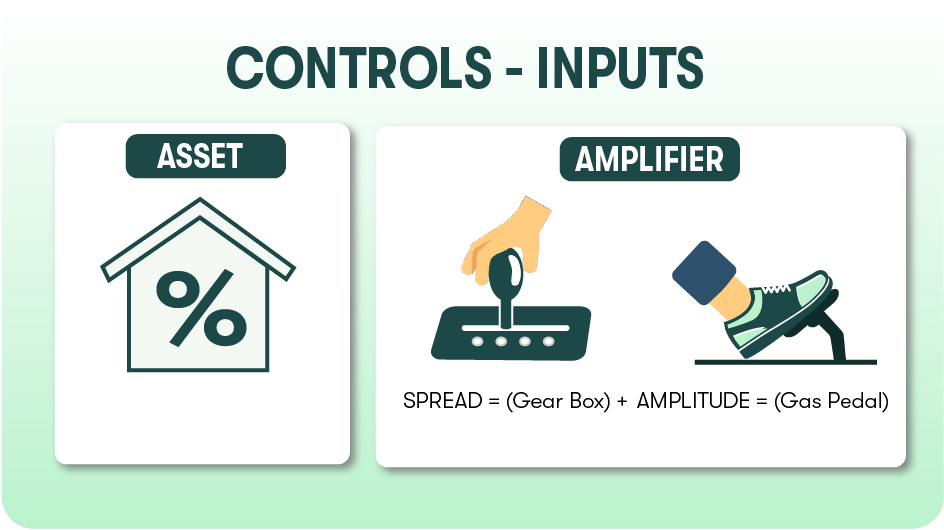

The asset and the amplifier are pieces of the investment that you set and control. The inputs, like a car’s gearbox and gas pedal.

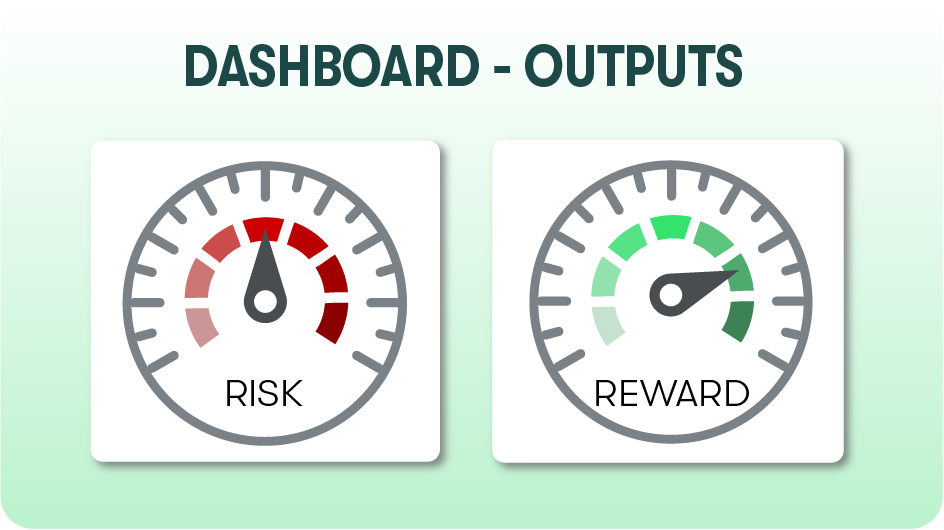

The car’s dashboard shows the results of your decisions as a driver. The gear you selected and how hard you press on the gas pedal. It shows you “the output.” In the same way, an investment dashboard shows you outcomes resulting from your inputs.

Building Wealth With Amplifiers

Most people are unaware that you can swap out the debt in an investment with a high-performing amplifier. A well-structured and highly optimized financial amplifier can supercharge your financial journey. It’s like driving a hypercar. A well-structured amplifier increases the yield of an investment. Traditional debt can do the same, but it also increases the volatility of the investment, which likewise increases the risk. A well-structured amplifier can minimize the increased volatility (lower risk than traditional debt) while maximizing the yield over time. This is the “engine” of investments that many are unaware of.

Getting behind the wheel of a hypercar requires education and confidence. However, if you’re willing to learn, you’ll get to your destination faster than you ever thought possible. There are equivalent financial vehicles. With the right amplifiers, you can reach your financial goals faster, safer, and with more certainty.

The Role of Financial Technology

Our proprietary Income Amplifier uses a combination of leverage, floats, and compounding. These financial strategies are optimized using cutting-edge proprietary technology we call I.R.I.S.

I.R.I.S sifts through hundreds of thousands of potential plans. It generates an optimal custom-built plan around your financial goals.

Technology is everywhere and evolving rapidly. Artificial intelligence, automation, and other advancements in information technology are setting the stage for more technological evolution.

Technologies like Siri, Alexa and Google Assistant that are ubiquitous in every household today are excellent examples of conversational AI.

We will soon have self-driving cars (autonomous car).

Self-flying aircraft will be taking off sooner than you think.

Can you imagine driving a car without a GPS these days?

Probably not.

Use Technology to Overcome Financial Stress

As a company, we believe it’s time we started using technology to reach our financial goals.

Typically, our students set up their Income Amplifiers in two weeks. Most see the first signs of positive results in 6 weeks. This process helps our clients achieve their passive income goals much faster than many other strategies using stable income-producing assets.

If they are behind, the technology recalibrates their plans to make sure they always have the most up-to-date and fastest path to their goals.

Hypercars are not for everyone, and neither is our AI-based Income Amplifier. It’s for working professionals who are willing to take the time to understand the power of these strategies and who meet the criteria.

In closing, I would like to end with a quote from the documentary.

“A car can’t do that. It can’t do that. And then, it does.”

Learn more about the Amplified Approach: