You spend your entire career working hard to live the lifestyle you desire, with the goal of maintaining this lifestyle once you retire.

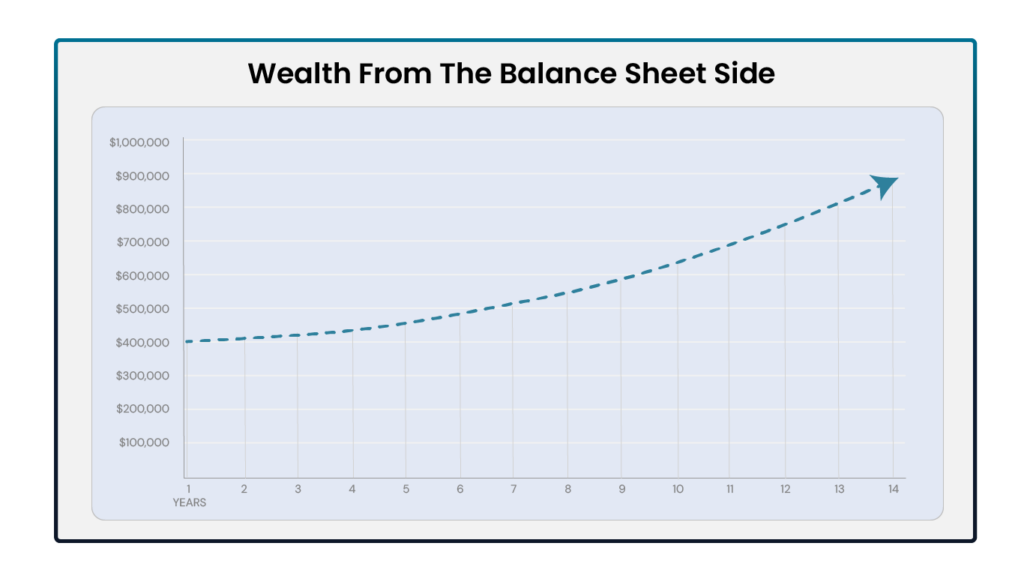

If you are like most people, in addition to investing in your career, you have probably also purchased your home, along with some other assets such as stocks, mutual funds, or maybe even rental properties. You may believe you have the assets needed to build your wealth. In your mind, your wealth trajectory looks like the image below. After all, the assets you have accumulated are supposed to keep appreciating at a good rate, right?

The Illusion of Building Wealth

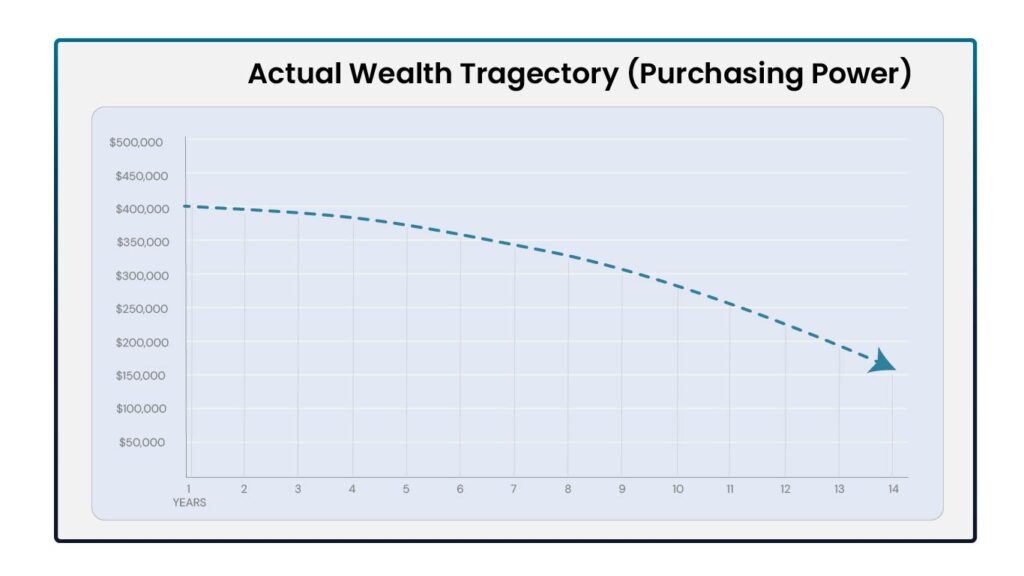

However, the reality of your wealth trajectory may be very different. Just because your assets are appreciating does nots mean you are building wealth. This is because you may not be accounting for the impact of inflation.

The chart below is a more realistic view:

The Truth About Building Wealth

The first chart shows the illusion of building wealth and may even be the same chart you have been following.

You have been planning and building your wealth, unaware that there is a critical problem. In your mind, you are doing all the right things. And then you retire, only to realize that something is off. You cannot quite put your finger on it, all you know is that you cannot maintain the same lifestyle for which you worked and planned so diligently. You wind up blaming yourself or your financial planner for your failure, never knowing that you were simply looking at the wrong metrics.

Great-Grandpa’s Vast Fortune

Imagine your grandmother telling you about the time her father inherited a vast fortune and thought he would live like a king forever. She then tells you that instead of spending the money, they saved every penny for you so that you would never have to worry about money again. You discover the “fortune” is $5,000…

How do you feel?

Back then, $5,000 was a significant amount. Today, it probably barely covers one month of your expenses. This is the difference between real versus nominal dollars. What used to be a large sum of money a number of years ago, can purchase much less in today’s economy. The same thing is happening in your own wealth-building plan. All your projections are based on dollar amounts that, in the future, will buy much less than you realize.

It’s time you opened your eyes to the problem because now you can do something about it.

Nominal vs. Real Dollars

Let’s lay the foundation to the solution by first talking about two important terms: “Nominal dollars” and “Real dollars.” To help us understand these critical terms, let’s consider this important question:

If you could collect $1,000 today or $1,500 in five years, which would you pick?

Most people will select one of these choices randomly. But let me give you a hint. If you had to buy something with that money, what could you afford with $1,000 today vs. $1,500 in five years?

You know what you could buy with $1,000 today, but you have no clue what you could buy with $1,500 in five years. This is because you don’t know what the price of various products will be in the future. The $1,000 are “real dollars” (today’s dollars) and the $1,500 are “nominal dollars” (future dollars). You have no idea what the purchasing power is of nominal dollars.

Would you prefer to have collected $750 five years ago or to collect $1,000 today? Again, most people will pick one of these choices randomly. But, if you had to buy something with that money, what would you have been able to buy with $750 five years ago versus what can you buy with $1,000 today?

With this second example, you can see that the concept of nominal dollars applies whether you are going backward or forward in time.

Implications Of Nominal vs. Real Dollars On Wealth Building

The table below explains the difference between nominal vs. real dollars:.

| Nominal Dollars | Real Dollars |

|---|---|

| Any reference to dollars in the past or in the future | Any reference to dollars today, in the present |

| No easy way to measure the purchasing power of these dollars, especially in the future | You know how much you can buy using this money |

| Cannot depend on a wealth-building plan based on nominal dollars alone | Wealth-building plans generated using real dollars are more dependable |

“Nominal dollars” is the amount of money (number of dollars) that you paid for something in the past or would pay for something in the future and does not account for inflation. You have no idea what you could buy or could have bought with nominal dollars. This is why you didn’t know whether to choose the $750 in the past or $1,500 in the future from the previous examples.

“Real dollars” represents what your money can buy today, accounting for inflation – it’s your “purchasing power.”

Ultimately, everything boils down to “Real dollars.” “Nominal dollars” doesn’t tell you much if you cannot translate and relate it to real dollars.

Real and Nominal Dollars in Practice

Which would you pick if someone offered to give you $5,000 today or $100,000 in 15 years?

Here is what you are hopefully thinking…“Hmmm… I can use $5,000 to buy a laptop and an iPad today, or I can have what feels like LOTS of money in 15 years!”

While $100,000 may sound like a lot of money, the question is whether it will buy you MORE or FEWER actual items 15 years from now. It feels like it should be able to buy you more, but how do you know?

The $100,000 is “nominal” and the $5,000 is “real.”

You hire an expert who tells you that with $100,000 in the future, you would be able to buy $6,000 worth of stuff today. The $6,000 is the equivalent “real” dollars of that nominal $100,000. You now know that picking $100,000 in 15 years is better because it will buy you more. The examples in this blog highlight the fact that nominal dollars don’t have a lot of significance. “real” dollars do.

Chart 2 shows real dollars – the decline of the purchasing power of your dollar. This is the chart you should be looking at. Unfortunately for many, the trajectory in real dollars is pointing downwards. It shows that in the future, you will not be able to afford your current lifestyle, let alone enjoy a lifestyle of financial freedom.

The very first step in building wealth for you and your family is lifting the veil on what you don’t know and creating visibility into your financial future.

If you are ready to take the next step on your journey towards financial clarity, make sure to attend our upcoming Wealth Journey Workshop.